REAL TIME NEWS

Loading...

Title XAUUSD H1 | Bullish reversal setup Type Bullish bouncePreference The price is falling towards the pivot at 5,132.95, an overlap support. A bounce from this level could lead the price toward the 1st resistance level at 5,244.43, a pullback resistance. Alternat...

Title XAUUSD H1 | Bullish reversal setup Type Bullish bouncePreference The price is falling towards the pivot at 5,132.95, an overlap support. A bounc

Bottom line: While historical patterns suggest geopolitical volatility tends to subside relatively quickly, the current environment remains exceptionally challenging. We are facing intersecting concerns—ongoing issues with AI, private credit, and now heightened geo...

Bottom line: While historical patterns suggest geopolitical volatility tends to subside relatively quickly, the current environment remains exceptiona

Crude Hits $120 p/bWe’re seeing record moves in oil at the start of the week with crude futures exploding higher. CL1 rallied around 30% from Friday’s close hitting highs of just shy of $120 p/b, levels last seen in summer 2022, before reversing lower to trade arou...

Crude Hits $120 p/bWe’re seeing record moves in oil at the start of the week with crude futures exploding higher. CL1 rallied around 30% from Friday’s

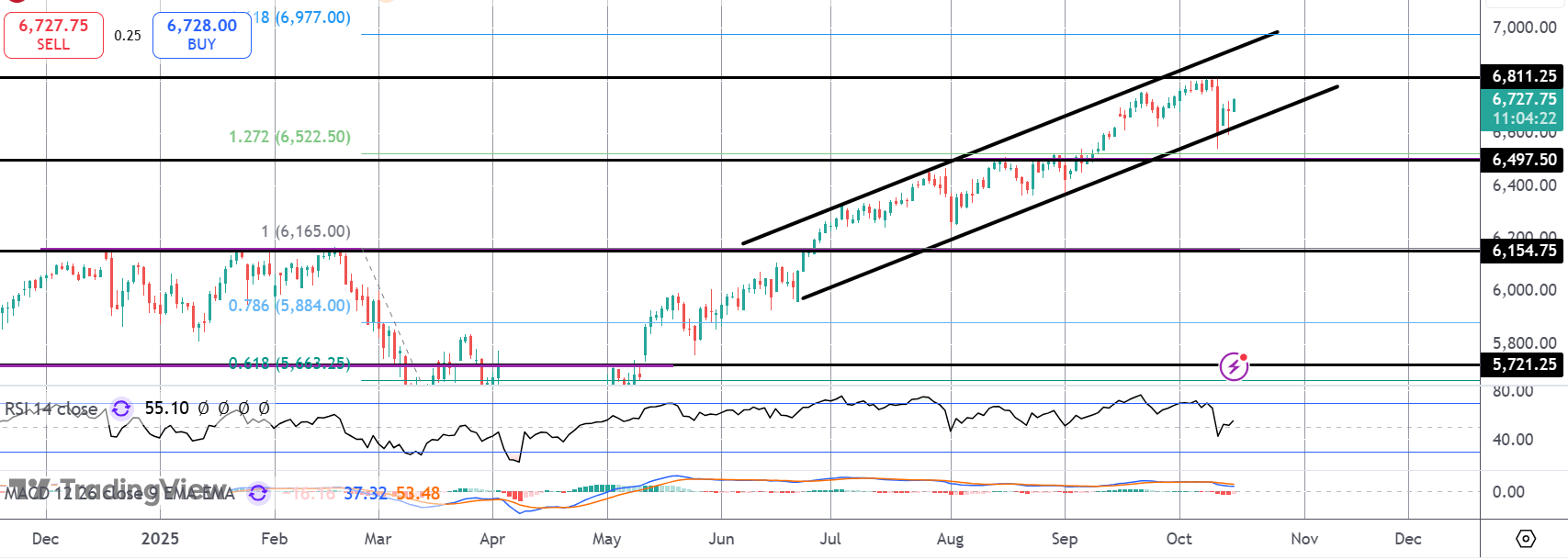

SP500 LDN TRADING UPDATE 9/3/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEAR ZONE 6560/50WEEKLY RANGE RES 6942 SUP 6558Weekly Straddle Range: 192 -point straddle implies a weekly range of [65...

SP500 LDN TRADING UPDATE 9/3/26WEEKLY & DAILY LEVELS***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***WEEKLY BULL BEAR

Title AUDCHF H4 | Bearish breakoutType Bearish reversal Preference The price is rising toward the pivot at 0.54729, a pullback resistance level. A reversal at this level could lead the price toward the 1st support at 54126, a pullback support. Alternative Scenario ...

Title AUDCHF H4 | Bearish breakoutType Bearish reversal Preference The price is rising toward the pivot at 0.54729, a pullback resistance level. A rev

Sell-Off Tests Key Support LevelThe sell off in US stocks has stalled for now with the ES bouncing off a key support level. Prices are down heavily from Friday’s close though the sell off was reversed as buyers stepped in at the 6,587.50 level. Bulls need to defend...

Sell-Off Tests Key Support LevelThe sell off in US stocks has stalled for now with the ES bouncing off a key support level. Prices are down heavily fr

Daily Market Outlook, March 9, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…Global equities saw a rebound after The Financial Times revealed that the Group of Seven (G7) nations are considering a coordinated release of petr...

Daily Market Outlook, March 9, 2026 Patrick Munnelly, Partner: Market Strategy, Tickmill GroupMunnelly’s Macro Minute…Global equities saw a rebound af

Title GBPUSD H1 | Bearish reversal off 61.8% Fib resistance Type Bearish reversal Preference The price is rising toward the pivot at 1.3444, an overlap resistance that aligns with the 61.8% Fibonacci retracement. A reversal from this level could lead the price tow...

Title GBPUSD H1 | Bearish reversal off 61.8% Fib resistance Type Bearish reversal Preference The price is rising toward the pivot at 1.3444, an overl

E-mini SP500 Weekly Live Market & Trade AnalysisReal time actionable analysis on futures markets. specific focus on E-mini S&P500. To review this week's video analysis click here!...

E-mini SP500 Weekly Live Market & Trade AnalysisReal time actionable analysis on futures markets. specific focus on E-mini S&P500. To review t

Deleveraging remained a dominant theme throughout the week, although some directional flows were observed alongside it. Unsurprisingly, given the unpredictable nature of the US-Iran conflict and the limited short-term visibility, both de-risking and deleveraging ac...

Deleveraging remained a dominant theme throughout the week, although some directional flows were observed alongside it. Unsurprisingly, given the unpr

.jpg)

.jpeg)