SP500 LDN TRADING UPDATE 28/1/26

SP500 LDN TRADING UPDATE 28/1/26

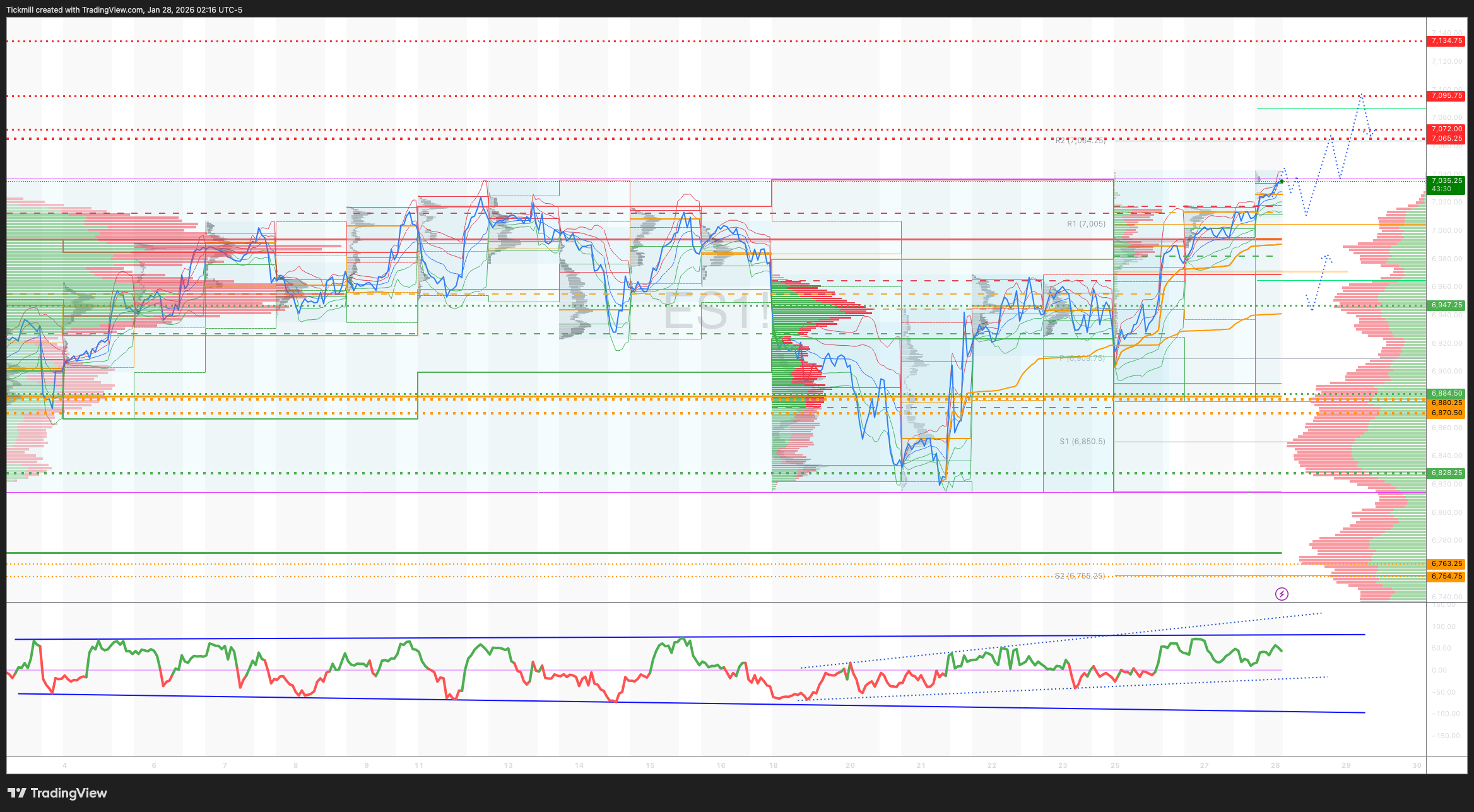

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6880/70

WEEKLY RANGE RES 7065 SUP 6928

FEB OPEX STRADDLE 6726/7154

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

The Gamma Flip Zone at 6972.75 is crucial; above it, the market experiences “Positive Gamma” with reduced volatility and easier upward movement. Below it, “Negative Gamma” results in erratic price action. Bulls must reclaim this level to stabilise the market.

DAILY VWAP BULLISH 6969

WEEKLY VWAP BEARISH 6961

MONTHLY VWAP BULLISH 6856

DAILY STRUCTURE – ONE TIME FRAMING HIGHER - 6988

WEEKLY STRUCTURE – BALANCE - TBC

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6775

DAILY BULL BEAR ZONE 6988/78

DAILY RANGE RES 7072 SUP 6847

2 SIGMA RES 7134 SUP 6828

VIX BULL BEAR ZONE 20

PUT/CALL RATIO 1.37

TRADES & TARGETS

PRIMARY PLAY - LONG ON REJECT/RECLAIM DAILY BEAR ZONE TARGET DAILY RANGE RES

LONG ON TEST ON REJECT/RECALIM DAILY RANGE SUP TARGET 6981

SHORT ON REJECT RECLAIM DAILY/WEEKLY RANGE RES TARGET 7040

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - “DISPERSION”

S&P closed up +41bps at 6,978 with a Market-On-Close (MOC) imbalance of $3bn to sell. The Nasdaq 100 (NDX) gained +88bps to close at 25,938, while the Russell 2000 (R2K) added +26bps, ending at 2,666. The Dow Jones Industrial Average (Dow) dropped -83bps, closing at 49,000. A total of 18 billion shares were traded across all U.S. equity exchanges, matching the year-to-date (YTD) daily average. The VIX rose +124bps to 16.35, WTI Crude surged +300bps to $62.45, the U.S. 10-year Treasury yield increased +2bps to 4.24%, gold climbed +178bps to $5,213, the U.S. Dollar Index (DXY) fell -125bps to 95.83, and Bitcoin declined -123bps to $89,055.

Momentum broke out to the upside today, with GS momentum pairs broadly up +2-5%. The NDX rose +1% and has now gained for five consecutive days, outperforming the R2K by approximately 3% during this stretch as the YTD performance gap narrows. A similar momentum pattern is evident in the Silver/Gold vs. USD chart. Notable contributors included GLW, up over 16% ahead of its earnings report tomorrow morning, driven by a multi-year agreement with Meta, and MU, which gained +5% on plans to build a new facility in Singapore, pushing STX and WDC up +3% and +5%, respectively. Big Tech earnings are due tomorrow, including META, MSFT, NOW, ASML, and IBM. Additionally, the FOMC meeting is expected to be uneventful, with no change in the federal funds rate, minor statement adjustments, and limited guidance on future policy.

In other sectors, managed care stocks faced significant pressure following a worse-than-expected Medicare Advantage (MA) rate notice last night, compounded by a more complex UNH earnings report and guidance this morning. Key declines included UNH (-20%), HUM (-21%), ALHC (-12%), and CVS (-14%). Hedge funds were heavily selling in this space, with a long-to-short sales skew. Conversely, hospitals performed well after HCA’s earnings, where positioning had been predominantly short.

Activity levels on the trading floor were moderate, rated a 5 out of 10. The floor finished with +245bps to buy versus a 30-day average of -108bps. Asset managers were net buyers by approximately $2bn, with broad demand across macro, industrials, materials, and energy sectors. Hedge funds were slight net sellers, driven by supply in healthcare, partially offset by demand in tech and industrials.

After-hours trading highlights: TXN rose +5% on better-than-expected quarter-over-quarter revenue guidance. QRVO dropped -8% following a Q4 revenue outlook of $775-825mn, significantly below the Street estimate of $904mn, leading to lower EPS guidance. STX was flat after beating expectations and guiding March EPS ~13% above Street estimates. NXT jumped +7% on a beat and upward FY revenue guidance.

In derivatives, it was a quieter day on the volatility desk, with spot vol action mirroring yesterday. Volatility remains elevated on the realized move to the upside ahead of key catalysts this week. Despite recent realized moves, short-dated gamma remains attractively priced. The implied move for Friday is ~1.02%, factoring in tomorrow’s FOMC meeting and earnings reports from four of the "Magnificent 7" companies. SPX and NDX volatility continue to outperform and are expected to maintain this trend, especially on non-event-driven market rallies. Desk flows were dominated by volatility buying, including short-dated SPX hedges and upside plays in SMH, SLV, GLD, and tech sectors. (Credit: Shayna Peart)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!