SP500 LDN TRADING UPDATE 14/1/26

SP500 LDN TRADING UPDATE 14/1/26

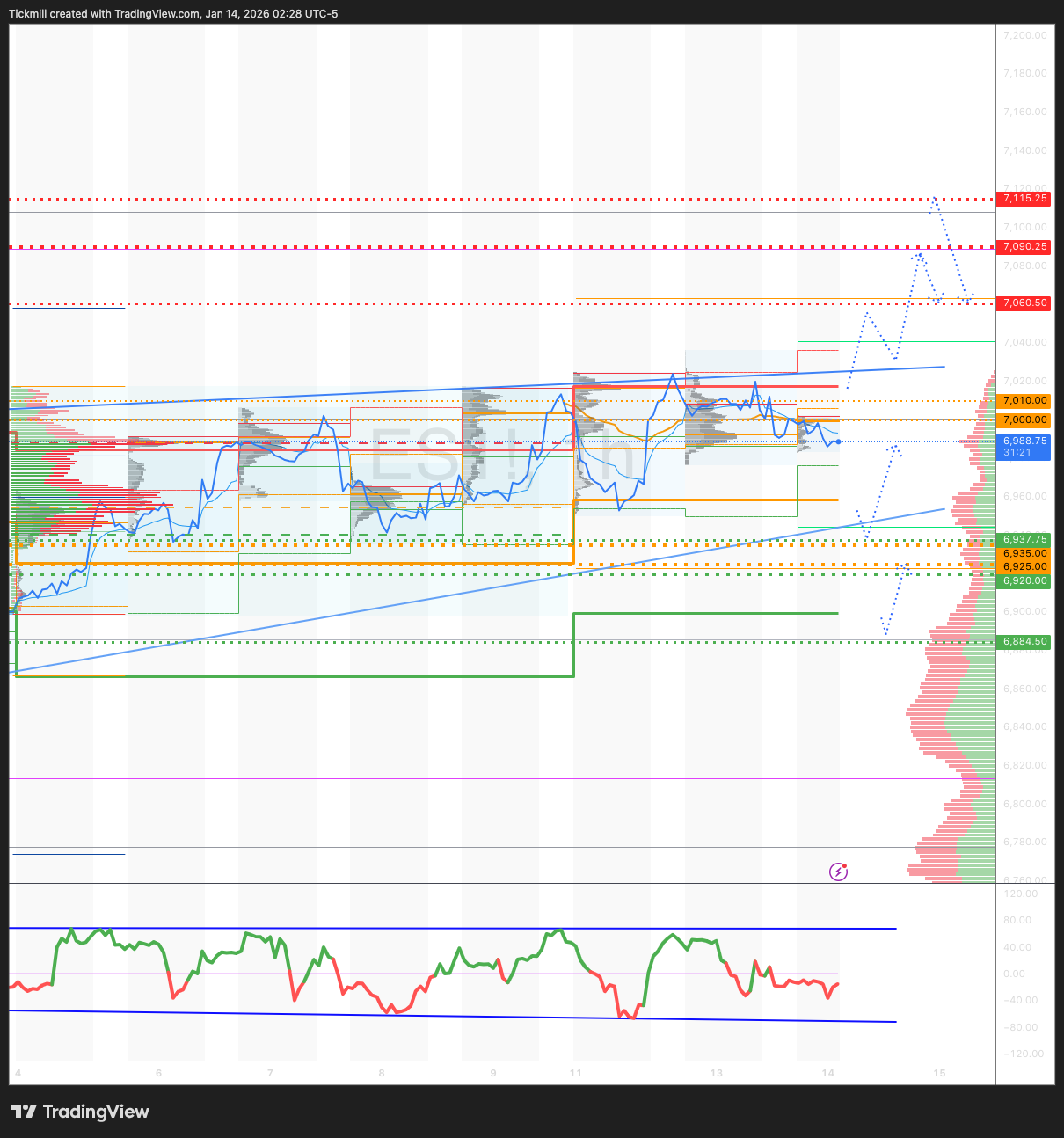

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6925/35

WEEKLY RANGE RES 7090 SUP 6920

JAN OPEX STRADDLE 6661/7008

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

WEEKLY VWAP BULLISH 6938

MONTHLY VWAP BULLISH 6854

WEEKLY STRUCTURE – ONE TIME FRAMING HIGHER - 6932

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6775

The SPX aggregate gamma flip zone is around the 6880 level. There is a sharp increase in upside gamma starting at 6970 and above. Conversely, below 6770, the downside gamma becomes very steep.

DAILY STRUCTURE – ONE TIME FAMING HIGHER - 6976

DAILY VWAP BULLISH - 6995

DAILY BULL BEAR ZONE 7000/10

DAILY RANGE RES 7060 SUP 6937

2 SIGMA RES 7115 SUP 6884

VIX BULL BEAR ZONE 17.7

PUT/CALL RATIO 1.27

TRADES & TARGETS

PRIMARY PLAY - LONG ON REJECT/RECLAIM DAILY RANGE SUP/ WEEKLY BULL BEAR ZONE TARGET DAILY BULL BEAR ZONE

LONG ON ACCEPTANCE ABOVE THE DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON REJECT/RECLAIM DAILY RANGE RES TARGET 7025 (ATH)

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - “UNPREDICTABLE”

S&P closed down 19bps at 6,964 with a Market on Close (MOC) flow of $2.8bn to buy. NDX dropped 18bps to 25,742, R2K down 9bps at 2,633, and the Dow fell 80bps to 49,192. Trading volume across all US equity exchanges reached 18.65bn shares, surpassing the year-to-date daily average of 17.17bn shares. VIX rose sharply, gaining 569bps to 15.98. WTI Crude climbed 271bps to $61.12, while the US 10YR yield remained unchanged at 4.17%. Gold slipped 23bps to 4,567, DXY strengthened by 29bps to 99.15, and Bitcoin surged 372bps to $94,398.

Earnings season began today with JPM falling 4% and BK rising 1.7%. Both earnings reports met high expectations but did not significantly exceed them. Activity levels in Financials—and broadly across sectors—were subdued, as investors avoided overtrading in a volatile, headline-driven environment. Two key themes emerged: 1) the "run it hot" trade (favoring capital markets, nominal GDP growth, and cyclicals) underperformed across subsectors like banks, alternatives, investment banks, CRE brokers, and payments; 2) financial services directly interacting with consumers faced headline risks, particularly following President Trump’s Truth Social post endorsing the Credit Card Competition Act. Money flows out of the sector dominated, with long-only investors showing patience compared to hedge funds, which have been rapidly adjusting exposures. A notable bright spot remains passive LO demand for alternatives.

Software stocks showed pronounced weakness, declining between 3%-7%. CRM, down 7%, had its worst day since May 2024, reflecting limited investor confidence heading into earnings and "source of funds" dynamics. CPI data released this morning showed core inflation at 24bps unrounded, below street expectations (GIR 0.35% vs. 0.3% consensus). The miss was slightly noisy, with no clear implications for Fed policy. GS Economics still anticipates the next rate cut in June.

Looking ahead, tomorrow’s key events include US PPI, Retail Sales, the Beige Book, and a potential decision regarding IEEPA/Supreme Court tariffs following last week’s lack of clarity. Notably, President Trump imposed a 25% tariff on any country trading with Iran. BAC, C, and WFC are set to report earnings in the morning.

Activity levels across the floor were rated a 4 out of 10. The floor finished +123bps to buy, compared to a 30-day average of -46bps. Asset manager flows were balanced, while hedge funds skewed slightly toward selling. Industrials showed strong buy-side demand, marking the highest buy skew since November and ranking in the 94th percentile on a 52-week lookback. Hedge funds last week bought Industrials at the fastest pace in five months, per Prime data. Buying stocks and sectors tied to cyclical reacceleration remains a prominent theme. ECM activity is expected to ramp up rapidly this week, with BTGO and EQPT launching as the first US IPOs, alongside several more anticipated in coming weeks.

In derivatives, markets experienced choppy price action amidst geopolitical uncertainty. While the S&P only closed down 20bps, intraday realized straddle action leaned to the downside. Iran-related headlines pushed vol of vol higher, with SPX skew following suit. However, spot vol and gamma failed to catch a meaningful bid. As vol of vol eased later, flows diverged—real accounts focused on buying puts and put spreads, while vol RV accounts faded the moves in vol of vol and skew. NDX vol continues to underperform SPX vol. Ahead of the potential IEEPA decision, RUT vol remains preferred over NDX. Implied moves for tomorrow: SPX 51bps, RUT 92bps, NDX 74bps.

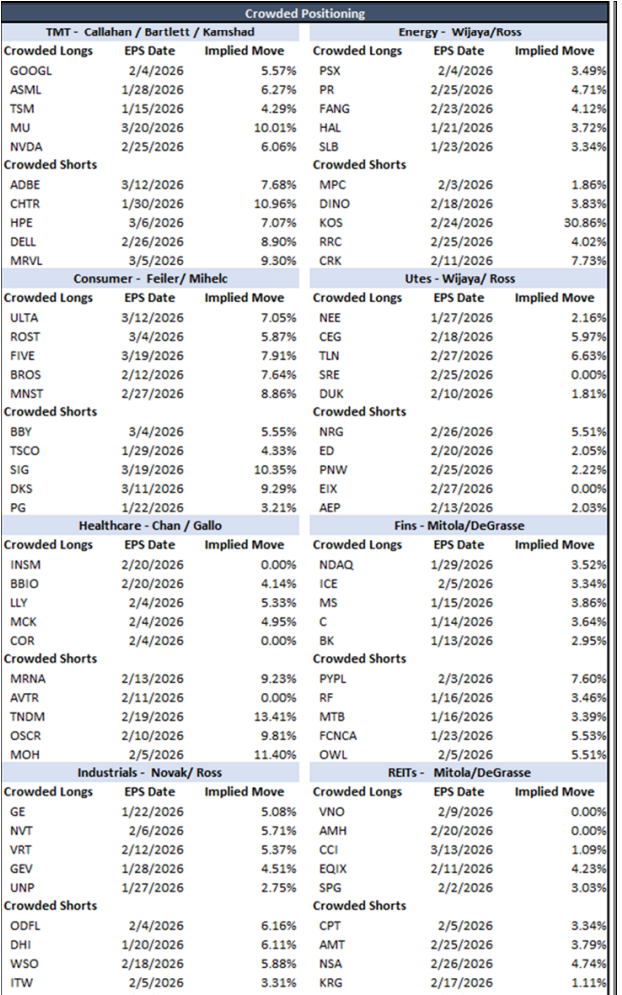

Top crowded longs and shorts, earnings setups, stock reactions, and key charts can be accessed here.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!