Gold Spikes Higher on Softer US Inflation

Gold Rally Continues

Gold prices are continuing to push higher through the middle of the week with the futures market hitting fresh record highs today. Yesterday, US CPI was seen inline with forecasts at 2.7% annualised last month. There was some undershooting on the monthly readings however with core remaining unchanged at 0.2%. Rate cut expectations for Q1 were little moved on the data with January still pricing no change and March still showing around 30% for a cut. Looking ahead today, focus will be on the latest US PPI data which, on the back of CPI yesterday, is expected on the neutral/soft side. We also have US retail sales which are expected to be more buoyant with headline seen rising to 0.5% from 0% prior.

US/Iran

Away from the US Dollar and Fed easing expectations, traders are monitoring the various risk threats active currently. The key issue here is the risk of US military action against Iran which remains elevated given the ongoing situation there. Iran has warned that any attack from the US will be met with counter attacks on US military bases in neighbouring countries. For now, the threat of a conflict between the two should keep gold prices supported on safe-haven demand.

US/Greenland

Rhetoric around Greenland is another driver of safe-haven demand currently. The US govt continues to insist that it needs to take Greenland for national security despite widespread pushback in Europe and the risk of NATO breaking down. While this narrative remains investor uncertainty should keep gold moving higher near-term.

Technical Views

Gold

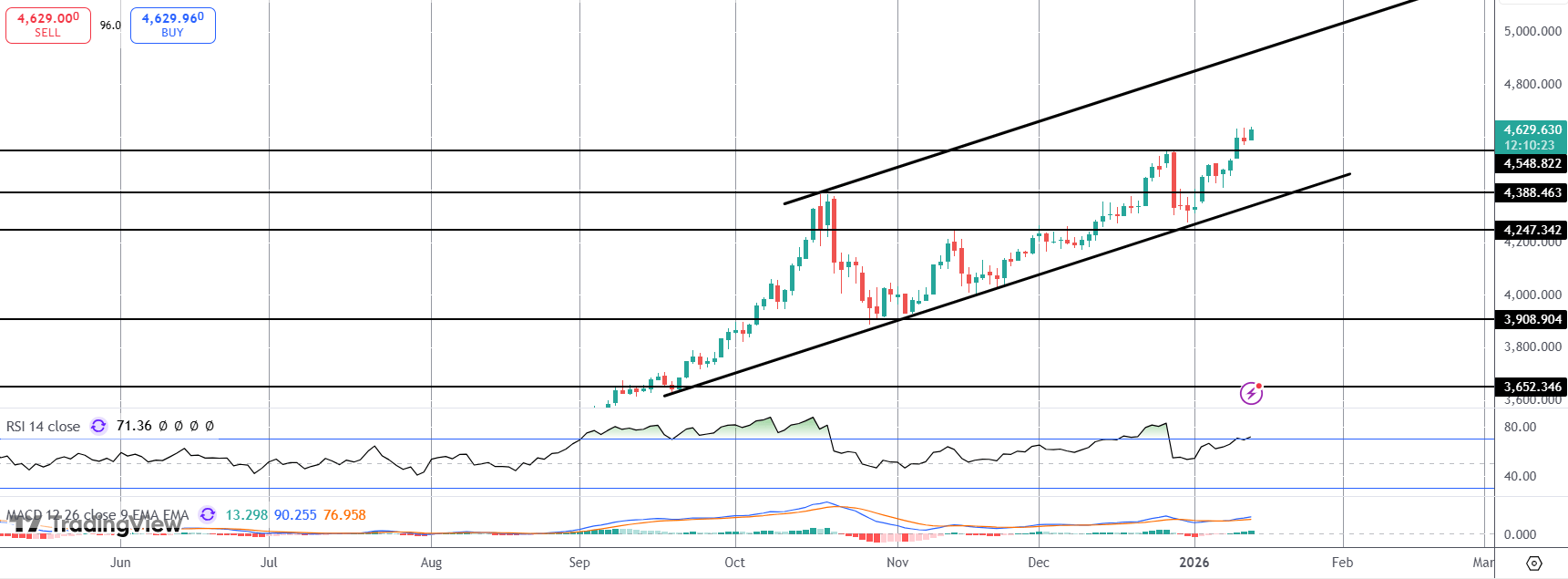

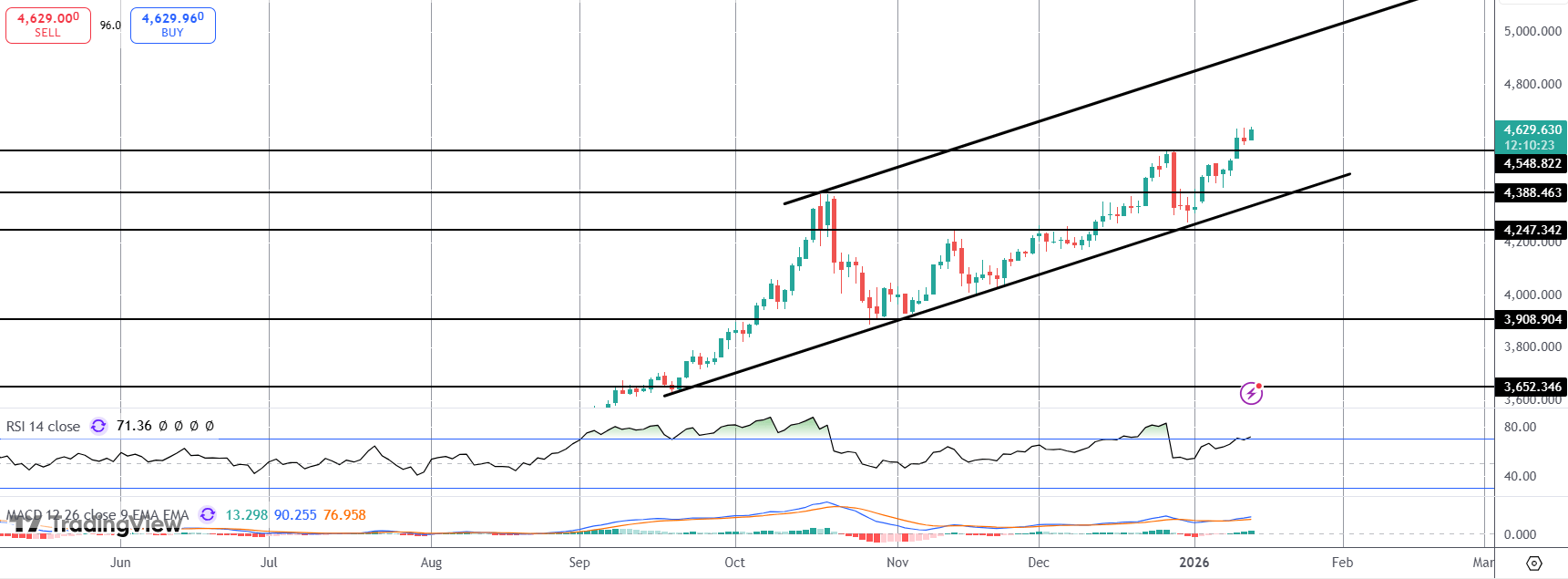

For now, gold prices remain stalled around the4,627 level which has held as resistance all week. While above the 4,548.82 level, however, focus is on a continuation higher with the channel highs and 5000-level the next bull objective to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.