Copper Testing Key Resistance Ahead of FOMC

US/China Trade Optimism

Copper prices are attempting to break higher today, shrugging off the strength in USD, as optimism ahead of an expected US/China trade deal grows this week. Trump and Xi are expected to announce a new bilateral trade deal when they meet tomorrow in Korea after a framework was agreed over the weekend following talks between US and Chinese officials. Positive comments from Trump yesterday alongside news of fresh Chinese purchases of US soybean cargoes have helped contribute to increased optimism midweek. The prospect of a deal is a major positive for global trade prospects and copper demand looks set to rise accordingly.

Fed & USD

Alongside US/China trade dela optimism, copper is also being lifted by expectations off a fresh US rate cut today. Despite the rally in USD, the Fed is widely expected to cut rates by a further .25% when it meets today, along with signalling that further easing will likely be appropriate in coming months. If confirmed, this should feed into bullish copper sentiment with USD expected to weaken in coming months once the dust has settled on any trade deal announced this week.

European Demand Rising

Finally, news that car sales rose for a third consecutive month in Europe over September has also been a bullish signal for copper this week. In particular, electric vehicles, which account for increased copper demand from the sector, were seen rising by a third against the prior reading. With European demand lifting and the prospect of increased demand in China, copper prices look poised for furtehr gains near-term provided a US/China trade deal is announced this week.

Technical Views

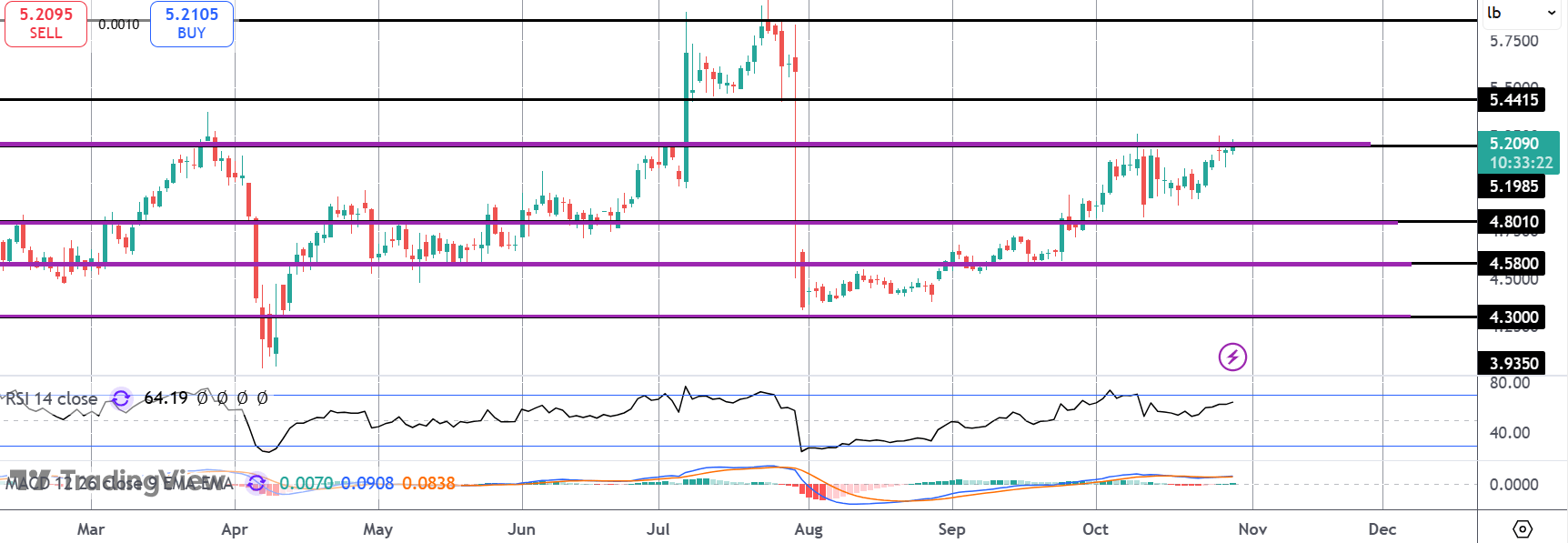

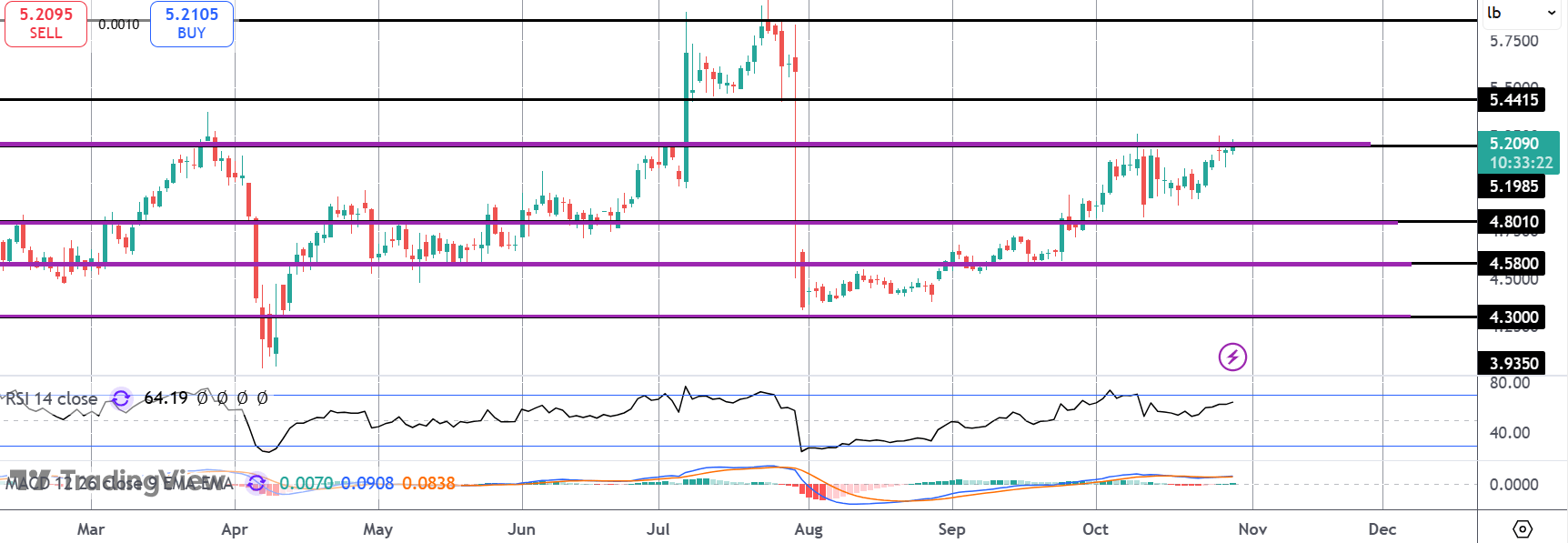

Copper

Copper prices are once again testing the 5.1985 resistance level which capped the rally earlier this month. While the level; holds, risks of a double top are seen, reinforced by bearish divergence in momentum studies readings. However, if we break higher, 5.4415 will be the next level to watch. To the downside, 4.8010 remains the key support to watch with the bullish outlook holding while price remains above that level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.